|

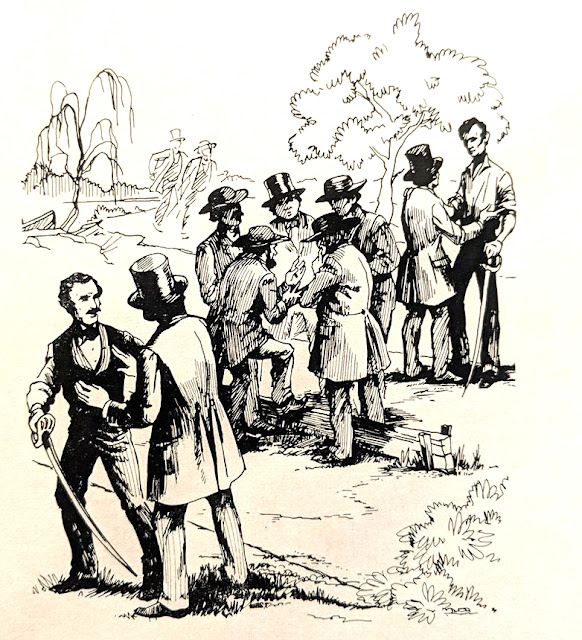

| Abraham Lincoln James Shields |

The relationship cooled, however, when Shields became the State Auditor. He passed a number of controversial measures and even instituted a policy whereby the state stopped accepting its own paper money as payment for taxes and other debts.

Lincoln expressed his disapproval in the most professional, statesman-like fashion he could think of: by anonymously lampooning Shields in print. He began composing letters to a Springfield paper deriding Shields' character as well as his policies.

Between August 19 and September 9, a series of letters addressed to the editor of the Whig paper, Sangamo Journal, from a fictitious farmer’s wife named Aunt Rebecca, pointed an accusatory and defaming finger at James Shields and the Democratic party. The letters were followed by a September 16th poem (related to the Rebecca letters), signed by fictitious Cathleen. The poem and likely two of the Rebecca letters were written by Mary Todd and her friend Julia Jayne. Mary was quite a satirical writer, and she was already very opinionated about politics. Lincoln only admitted to writing the second Rebecca letter, which landed a blow directly at Shields. The letter was a doozy! Read this complete "Rebecca" letter; Lost Townships, August 27, 1842.

Poking fun at Shields wasn’t hard to do. He was notoriously pompous, vain, and a tad eccentric. Opponents dubbed him “an irresistible mark for satire.” He also poked fun at Shields' lack of romantic game. One letter signed "Rebecca," quoted Shields as saying, “Dear girls, it is distressing, but I cannot marry you all... It is not my fault that I am so handsome and so interesting.”

Before sending his note off to the editor, Lincoln shared it with his soon-to-be-wife Mary Todd and her friend Julia Jayne. The two women contributed a few quips to Lincoln’s letter and even began writing memos of their own.

The letters soon became the talk of the town. Though Shields was generally well-liked, people got a kick out of Lincoln’s hilariously spot-on satire. Shields, however, didn’t get the joke. Incensed, he contacted the paper’s editor and demanded to know “Rebecca’s” identity. The editor gave him Abe’s name — as per Lincoln’s instructions.

Upon learning the identity of his defamer, Shields decided to settle the matter by challenging Lincoln to a duel to the death. Though Lincoln thought the whole thing was absurd, he knew that backing down from a duel was never the honorable thing to do.

Duel Rules

As the one who’d been challenged, Lincoln got to select the conditions of the duel. He had a grand old time conjuring up the most ridiculous set of circumstances possible. To begin with, he named the cavalry broadsword as the weapon of choice. (“I didn't want the damned fellow to kill me, which I think he would have done if we had selected pistols,” he later explained.)

These conditions gave the 6’4” Lincoln a serious advantage over his 5’9” opponent. Lincoln was sure Shields would back down.

Not the case.

On September 22, 1842, Shields arrived at the duel site near the city of Alton, ready to face any challenger who might be foolish enough to face him.

While the two men were gearing up to face off, one spectator noted how grave and serious Lincoln looked. “I’d never seen him look so long before making a joke, and began to believe he was getting frightened.” But all of a sudden, Lincoln reached up and casually sliced off a branch with his sword. Again, it was an effort to scare Shields into submission.

But his opponent’s impressive display of arm-span still didn’t deter the scrappy Shields. The duel was about to commence when a few mutual friends arrived and intervened. Colonel John Jay Hardin helped the two reach a face-saving compromise, working it out with words instead of swords. Lincoln offered up a mea culpa and admitted that he’d authored the letters.

Everyone standing on the levee was relieved (but probably a hair disappointed) to learn that the “body” on the boat returning from the island was really just a log in a red shirt – a simple prank set up by a mutual friend.

When the boat reached land, Lincoln and Shields stepped off together, chummily chatting away. Upon viewing spectators’ horrified reactions, they both broke into fits of laughter at how absurd the whole situation had been.

The two men buried the hatchet (or broadsword) and remained friends from then on. Lincoln wasn’t exactly proud that he’d almost dueled against a political opponent. In fact, he was pretty embarrassed. When an officer asked him about the event years later, he replied, “I do not deny it, but if you desire my friendship you will never mention it again.”

Lincoln never again got tangled up in the makings of a duel. Shields, on the other hand, found himself involved in such proceedings in 1850, when on behalf of Democratic Congressman William H. Bissell, he presented the acceptance of a challenge to a duel issued by future Confederate president Jefferson Davis. But he immediately set to work settling the matter without violence. He was successful.

The Sport of Pistol Dueling in the 1900s.

Compiled by Neil Gale, Ph.D.